ISA vs Student loan. What should you choose?

While, a student loan is a debt, an obligation that needs to be paid under any circumstances, ISA is an investment in your career. An investment that fully depends on your success and is to be repaid only on the condition that you get the job.

Bunty is a bright student with career aspirations. He identifies himself as a tech-lover on Instagram and plans to pursue Software Development as a career, but the courses available are too expensive for him to afford.

Yes, he could get a student loan and get admission to a college but he doesn’t want to carry that risk – What if he couldn’t get a job? Is there no other option? Bunty envisions how great it would be if there was a ‘study first, pay later’ system. A system where he’d pay only if he gets a job?

Origin of Income-Share Agreements

In 1955, Milton Friedman, an American economist, and a Nobel laureate had a revolutionary idea – What if, instead of loans, education could be financed in the form of investments? What if one could invest in the human capital i.e. knowledge, skills, and experiences of individuals?

He proposed an agreement where one could finance a student’s education by providing them with the initial funds in exchange for a fixed share of the student’s income. These agreements would later be known as Income Share Agreement (Pay After Placement).

It was first adopted at Yale University in the US from 1971 to 1978. Since the first attempt, Income Share Agreements have evolved significantly and many different versions have surfaced online.

Today, a number of private-owned educational institutes have come up with bootcamps and structured learning programs under ISA where they teach in-market skills such as coding, data structure, web development, and even marketing courses in SEO, Google ads, etc. Students join these courses without paying anything upfront and come out with high placement prospects.

But, how does all of this work? How come the schools charge nothing and still sustain?

How do Income Share Agreements work?

ISA is a contractual agreement between the student and the school which works like this :

- School bears the education cost of the student.

- In exchange, the student, upon landing a job, gives a fixed percentage of their monthly income as payment towards the school for a set time period.

Generally, the student starts repaying after the end of the program and only when they’re earning a specific income (Income Threshold). The amount they’ll pay each month and the time period for which they’ll continue making payments vary from school to school.

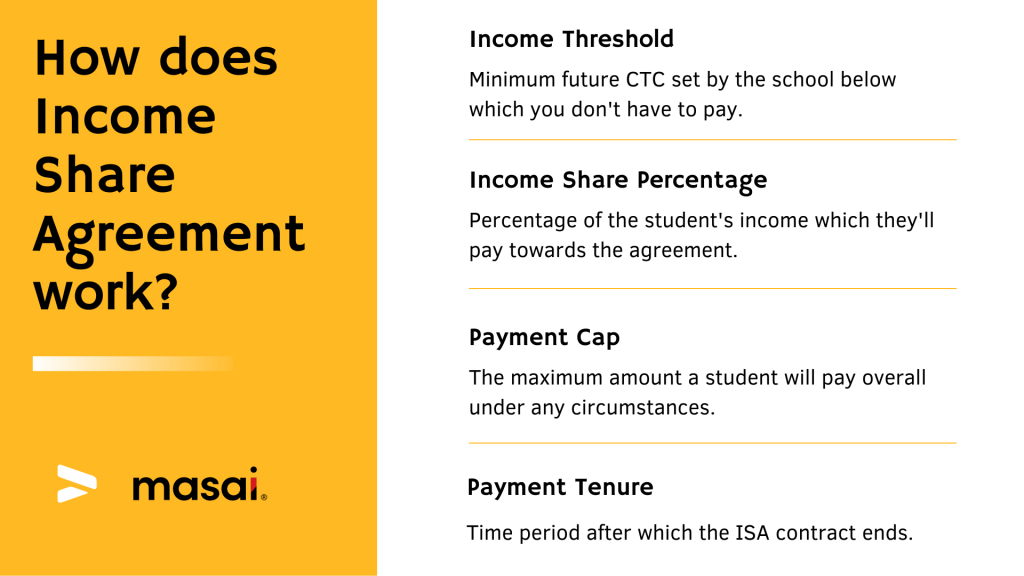

However, these 4 fundamentals govern the ISA contract in each school’s case :

After going through these terms, it should be clear that a student will keep making payments until :

- They’ve paid the Income Share Percentage for a fixed period,

- Or if, they’ve reached the maximum Payment Cap.

If the student is unable to get placed after the program, they’re not asked for repayment.

This is the central idea behind ISA-based education and the major distinction between student loans and Income Share Agreements.

Education loans in India

Student loans have been a tried and tested formula for financing higher studies and have been around for a long time. It all started with SBI, back in 1995 and then the other banks followed suit.

However, there are a few major restrictions with these loans; Bunty’s case is not an exceptional one. It’s the same with thousands of other students.

The idea of defaulting on loans and getting penalized doesn’t sit well with students.

In fact, 9.55% of the student loans extended by public sector banks were declared as non-performing assets for the financial year 2021. (From an article in TOI)

That amounts to approximately 3.5 lakh students who have fallen behind on their installments for more than 3 months. They’ll face further consequences in the form of credit score damage. And, as for banks, a large number of loan defaults negatively affect their profitability and net worth.

But, what could be the reasons for such a huge gap in Indian Education Finance?

Let’s go through a few plausible explanations that make sense :

- Outdated curriculum – Companies prefer candidates who’re good at the practical application of subjects. However, traditional colleges aren’t able to provide such skilled learning to students which makes it difficult for them to find employment opportunities after graduation. And that’s how these students end up as non-performing assets.

- Low-paying Jobs – India faces a low wage problem in many sectors and loans that are lent to these sectors most often end up as defaults. One prime example is the nursing sector which accounts for over 14% of the total NPAs.

- Dropout Rate – There has been a significant increase in the college dropout rate owing to the covid outbreak. Even earlier, students had been dropping out of courses either due to lack of interest or family responsibilities. Many of these students aren’t able to secure profitable jobs and thus end up as non-performing assets.

Quite clearly, we can’t turn our eyes away from the rise in loan defaults and the negative impact they have on people’s lives. Many careers sink beneath the burden of debt.

But what other options are there?

Can ISA-based higher education fill these gaps to some extent? Do students see these programs as a better alternative to loans?

Before getting into the nitty-gritty of decision-making, let’s focus on the key differences between ISAs and Student loans to help you understand your options better.

How are ISAs(Pay After Placement) different from Student loans?

Both ISA and education loans are a great service to students in need, to help them shape their careers. The basic difference lies in the functioning of the two.

While, a student loan is a debt, an obligation that needs to be paid under any circumstances, ISA is an investment in your career. An investment that fully depends on your success and is to be repaid only on the condition that you get the job.

Here are a couple of other major differences which will give you a more detailed insight :

1) ISAs are easily accessible – Education loans have strict eligibility criteria. Especially, in India, getting access to an education loan is a hustle in itself. Some loans require security collateral and if that’s not all, a guarantor and a solid credit history are needed too. Add to that, the multiple stages of documentation and verification and about a dozen visits to the bank.

Getting funds under ISA is way simpler. There are no difficult terms of enrollment, no demand for collateral here. Most ISA-based schools take a merit test to select the deserving candidates and then the agreement is signed with ease.

2) ISA payments are more flexible – The monthly installments one makes towards a student loan are fixed. Regardless of whether you have a low-income job or you’re not working at all, you have to pay a certain amount every month. Whereas, EMIs in ISA can be lowered or paused depending on the employment situation of the student.

Unlike student loans, ISAs don’t accrue any interest on repayment.

3) Student loans are regulated – Government and private education loans are properly regulated and have a legal framework for operation. Since ISA is a relatively new model, such regulations are still in the making. However, it is a legally binding contract and any offense by either of the parties involved would be penalized just like any other agreement.

4) ISAs have a validity period – Since ISAs have a fixed ‘payment cap’ and ‘payment term’, they save student borrowers from making excessive payments for long periods of time. The contract comes to a close when either of the two gets fulfilled :

- The total amount paid reaches the payment cap set by the school,

- Or if the payment period tenure comes to an end.

Case in point Mohamed Hassan, one of Masai School’s alumni got placed with Sharechat and repaid his ISA principal in a record 12 months’ time.

In this video, Hassan shares important insights on his Income Share Agreement journey.

In contrast, student loans don’t have such defined criteria and they often overburden students with fixed loan installments which keep on piling and it takes years until the loan is paid off.

We have summarised the information for you in the given table :

| Income Share Agreement | Student Loan |

| Easily accessible, no security collateral asked. | Security collateral is needed to get loan approval. |

| Flexibility in repayment depending on the state of employment. | EMIs for student loans are fixed regardless of the employment state. |

| No added interest rate on the repayment amount. | All student loans accrue heavy interests. |

| A fixed payment tenure post which the student is free of all payments. | No fixed time period. Keep making payments until the loan is paid off. |

By now, you must be aware of the many advantages that ISAs have over student loans. However, like everything else under the sky, they also have their own limitations and we have covered them in the section below to ensure that you make a well-informed decision.

Limitations with Pay After Placement

Remember Bunty? Let’s take a different case scenario. Bunty is looking for higher education but he’s not interested in a job. Instead, he has plans for his startup and he would start working on it right after finishing college.

Will ISA be the right option for him?

Not in this case.

These agreements are specifically modeled to land you a job. Most of the ISA-based schools offer job search assistance and set up ample placement opportunities for their students. Securing a job that pays over the threshold income is the primary shared objective between both parties while signing the contract.

So, it is not the ideal career path for students who are :

- Not willing to work a job after graduation and have other plans,

- Interested in acquiring higher education after the ISA based course,

- Not sure about the career or industry they want to work in.

Besides, there are a few organization level limitations as well which you should be informed of :

ISAs are unregulated as we mentioned in the previous section. They don’t have a centralized set of rules on how to operate. Hence, all the institutes offering ISA have different program structures and payment terms while working on the same principle. That leads to confusion among students. One should examine the agreement with utmost focus before finalizing it. (Know everything about Masai School’s ISA)

Pay After Placement models are less popular than student loans. Therefore, they’re less into practice. Only a handful of colleges and bootcamps are offering ISA worldwide, at present. This is the reason why there aren’t many courses available under these agreements. However, given the student debt crisis and the multiple benefits they have over student loans, ISAs are highly likely to grow fast and become mainstream in the future year.

Coding Bootcamps with Pay After Placement

Accelerated training programs have gained popularity in recent years as an alternative to higher education. These programs focus on skill development and application in order to prepare students for industry jobs.

The most common among these are coding schools/bootcamps that teach programming skills and set students up for lucrative jobs in the field of software and web development. These academies are the front runners when it comes to offering ISA. Their job-oriented courses act as a bridge connecting education and work and make them perfectly suited for the ISA model.

Masai School is one such institute in India, on a mission to upskill the untapped, underutilized talent in tier 2 and tier 3 cities and enable them to unlock their full potential and work high-paying jobs (>5 lacs) in software engineering. This year itself, we have achieved a 92% placement record with the highest package reaching a staggering Rs 36 lakhs.

Lambda School and Brainstation Miami are other notable mentions from the US offering ISA in the software education sector.

And it’s no surprise that even the companies today are preferring job-ready candidates coming out of such programs over traditional college degree holders. Most new-age companies and unicorn startups are hiring based on practical skills and implementation. And this trend is likely to continue.

Though ISAs have made a good impact on the world of education, they’re still limited in their expansion and delivery. Government subsidized student loans are way too ahead operating on a whole different bandwidth. In that case, what does the future hold for ISA-based education?

- Will Income Share Agreements continue to be offered only by privately owned accelerated programs and bootcamps?

- Or will they expand their niche and become mainstream?

- When will the government make an explicit legal framework around ISAs? Will they be centralized?

These are some questions to which we don’t have a concrete answer, but one thing is for sure that this innovative, logical, and problem-solving education model called the ISA is here to stay and change the lives of millions in the days to come.