Everything you need to know about Income Share Agreements (ISA)

Students can enroll and attend the Masai School with Zero enrollment cost, then upon completion pay 15% of their salary + GST as applicable and (only if salary isRs. 5 LPA or more) for 3 years, and the total payment is capped at Rs. 3 lakhs.

What are Income Share Agreements?

An Income Share Agreement(also called Pay After Placement) is a unique financial structure arrangement where an individual or organization provides something of value – Training, or a loan to a recipient who, in exchange, agrees to pay back by sharing a certain percentage of their income for a fixed period of time, or until the agreed loan has been repaid.

Access to quality education is still a big challenge in India, and many other developing countries. Multiple factors cause the differences in education level among all sorts of social classes or regions. Among those factors, financing the cost of education is the most crucial factor for so many students or professionals, to get quality education.

- Current financial instruments available such as Education loans or Personal loans are not efficient and accessible to everyone.

- Often, students are left with a high debt burden, which forces them to quickly find jobs that might not fit their skills and aspirations.

Now, let’s try to understand why ISA has become so popular and is widely being accepted. ISA may not seem like the noblest thing but credit where credit’s due, it makes institutes work hard with their students. Institute’s in-turn become accountable, therefore the efficiency of performance increases in all aspects.

Another advantage of ISA is that, for people with limited financial resources, it seems to be the perfect solution and much better than student loans as there is 0% interest, and students are required to pay back only once they’re placed.

Interesting, isn’t it? Before we jump to conclusions about ISA, let us learn more about its history, which will help us find context.

History/Genesis of Income Share Agreement

To understand ISA, we need to understand the genesis of ISA, and for that, we need to dive into the history of ISA, and the concept.

The concept of Income Share Agreements was first proposed by Milton Friedman 1955, an American economist and statistician, In his essay “The Role of Government in Education”, he argues that students might be funded beneficially through an “equity investment” such that

“[Investors] could “buy” a share in an individual’s earning prospects: to advance him/her the funds needed to finance his training on condition that he/she agrees to pay the lender a specified fraction of his/her future earnings. In this way, a lender would get back more than his initial investment from relatively successful individuals, which would compensate for the failure to recoup his original investment from the unsuccessful.”

In the 1970s, Yale University later experimented with a modified form of Friedman’s proposal where experimental student cohorts were required to pay back a percentage of their earnings until the entire student cohort’s balance was paid off. This faced backlash because some students ended up paying more than their fair share on behalf of their peers.

Since then, ISAs have evolved and have been put in use by different educational institutions to suit their unique business scenarios. It is increasingly becoming popular as a business model, and an alternative to traditional educational loans.

With many premier institutions and colleges providing for ISA, its adaptability has been catalyzed, and with the trend now reaching India, and many other countries with immense reserves of untapped talent.

Income Share Agreements in India

With the risk now being shared by both educational institutions and students alike, the adaptability of ISA has been fast and is predicted only to grow especially in nations like India, where the audience demographics include young people with limited skills and a dearth of job opportunities.

India has massive potential in terms of young, raw talent which is waiting for an opportunity to help them upskill, thereby making them employable. With this comes the interest of many entrepreneurs who have actively been working in courses with ISA offerings.

Our Founder – Prateek Shukla realized this massive opportunity after his experience as an educator with Teach for India, and he founded Masai School in 2019. The aim was to make a dent in the educational system and become a skill-building institute that focuses on outcome-based learning.

So far with our Pay After Placement(PAP) model, 250+ students have graduated from Masai School with an average package of Rs 6.75 LPA, with most of our students coming from non-technical backgrounds, and diverse educational degrees such as B.Com, BA, BSc, MSc, among others.

Benefits of Income Share Agreement

Income Share Agreements offer a variety of unique advantages that have made them very popular. Let us discuss some benefits of ISA –

- Increased accessibility for students – Financial factors are the biggest hurdle stopping a student from access to good quality education. With the unique payment terms of an ISA, the courses, education as a whole have become more accessible to the students.

- Reduction of Risk – Earlier, students needed to ensure that they worked hard anyhow to succeed, and the educational institution would not be held accountable or responsible in case the student does not fare well. But with ISA, the risk is distributed and the goals of success are aligned between the student and the educational institution.

- Active participation from Educational Institutes – With accountability for success being shared, it becomes vital for educational institutions to be agile, and constantly innovate, and evolve intending to maximize output for their students. With this in play, the chances of educational institutes getting complacent is reduced to zero.

College Tuition v/s Pay After Placement

Before we get into the differences between Income share agreements and the typical college tuition, one needs to understand that a regular education loan is an external financial instrument that allows a student to take a loan against collateral, to pay for their college education.

But ISAs are a way to invest in people’s careers, based on their potential. Although ISAs are not meant for everyone, having limited applications is bound by terms that are different from a typical educational loan.

Here are some differences between Income Share Agreements, and a typical student loan –

- ISAs require no security collaterals, whereas some education loans require collaterals before distributing loans. In the case of education loans, a guarantor and a solid credit history may be needed, limiting access to educational loans.

- ISAs carry no interest rates, however educational loans levy heavy interest rates

- Payment Flexibility – ISA offers payment flexibility. It means that the student must only pay back a fixed amount of their future income and their payments will get paused when their income falls below the threshold, or in case they lose their job, unfortunately.

- Education loans/ loans of any other forms cannot be paused, whereas the ISA followed at Masai School can be paused (after informing Masai) in cases where the student loses the job, or their income falls below the minimum threshold of Rs 5LPA.

- Loans can levy late fees or fines in case of delays in payments, but in ISA that is not the case. As mentioned above, in case of challenges, the students can opt to pause their ISA during emergencies.

PAP at Masai School

Masai School offers 30 weeks of full-time and part-time online software development programs where students don’t need to pay anything to the school until they get a job of 5 LPA or more after graduation.

Students can enroll and attend the Masai School with Zero enrollment cost, then upon completion pay 15% of their salary + GST as applicable and (only if salary isRs. 5 LPA or more) for 3 years, and the total payment is capped at Rs. 3 lakhs.

ISA consists of the following main terms which decide the payment structure of a student:-

- Income Share Percentage is in proportion (in %) of the student’s annual salary (CTC) that they pay every month. ISA is capped at 15% of the student’s annual salary plus 18% GST.

- Income Threshold is the minimum annual salary (CTC) that the graduates must earn for being liable to pay. Income Threshold Rs. 5,00,000 per annum (CTC) which equals to Rs 41,667 /- per month (CTC)

- Payment Cap is the maximum amount that a student will repay under any circumstances. Maximum Payment cap Rs. 3,00,000 (inclusive of GST@18%)

- Payment Tenure is the duration for which the student is responsible to make their ISA payments. Payback Period is 3 years (36 months).

- ISA validity period is the time limit till the ISA will be valid after a student’s graduation. ISA is valid for a period of 4 years (48 months) from the date of graduation.

How does Masai’s Pay After Placement work?

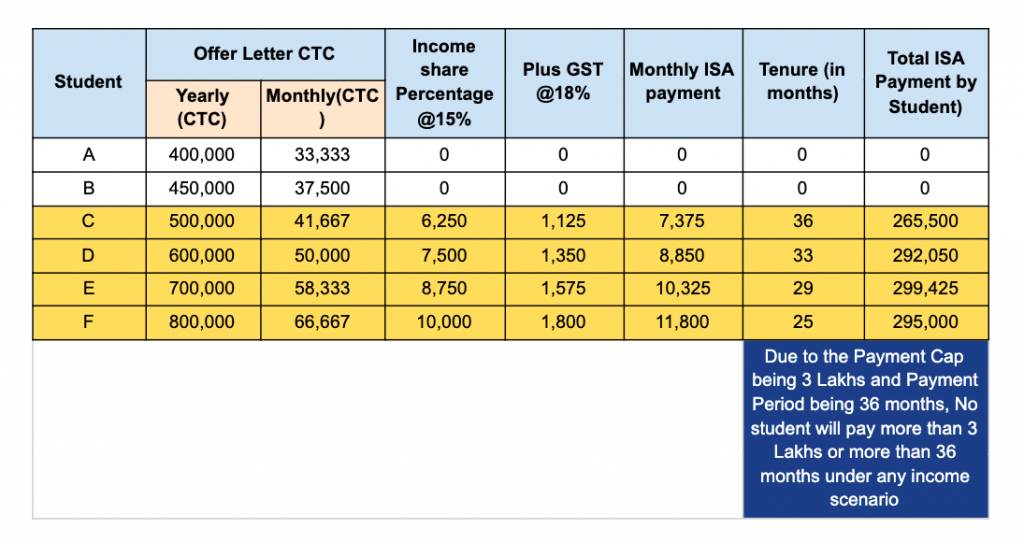

Let’s say 6 students (A, B, C, D, E, and F) enroll in the Full Stack Web Development program at Masai and sign an ISA where

- Income Threshold – Rs. 5,00,000 per annum (CTC)

- Income Share Percentage – 15% (plus GST@18%)

- Payment Cap – Rs. 3,00,000

- Payback Period – 36 months

In that case, this is how the payment structure of all students will look like:-

Few more things that you should know about Masai’s ISA are as follows:-

1. You will keep paying your monthly ISA payments till either of the following 3 things happen –

(i) You have paid 15% (plus 18% GST) of your monthly income for 36 months

(ii) You have reached the maximum payment amount of ₹ 3,00,000 (Including 18% GST)

(iii) If you did not find a qualifying job in tech for 1 year after graduating from Masai school

2. Your ISA payments will be paused if your annual income drops below 5 LPA. (*Subject to terms and conditions)

3. If you decide that Masai school is not for you, you can withdraw within the first unit without having to pay training fees. But if you decide to drop out in Unit 2 to Unit 6, the training fees would be as follows –

| Unit – 1 | No Payment |

| Unit – 2 | 50,000 |

| Unit – 3 | 50,000 |

| Unit – 4 | 50,000 |

| Unit – 5 onwards | 100% ISA payment |

4. You are required to report any changes in your income as per the PAP to Masai School

(i) Your monthly salary slip

(ii) Your Annual ITR (income tax return)

(iii) Every time your income increases or decreases

When you should opt for the ISA and when you shouldn’t?

Although Income share agreements are attractive financial instruments, it isn’t meant for everyone, and before signing up for an Income share agreement, one should evaluate their goals, and spend time in examining the structure of the deal very well before pursuing the idea of ISA.

(A) Opt for ISA when:-

- You don’t want to put your education financial burden on your family

- You are aiming for a career and not just for a job

- You are confident and determined to succeed in your chosen career

- When you are willing to share the risks along with the School

(B) Don’t opt for ISA when:-

- You are not willing to work after completing graduation

- Looking for just a certification to add to your resume

- Looking to pursue higher education after the ISA based course

- Looking for only placements

- You are indecisive about the type of job you want or the industry in which you want to make a career

Common Concerns with Pay After Placement

Critics believe that Income Share Agreements are vicious circles of never-ending debt, which is not entirely true. Before signing any agreement one can carefully examine all the terms and conditions, and sign up for it only once they are convinced.

ISA by itself is just a tool, therefore like any other tool, it can be good or bad. For example – If you take a loan, a lot of your experience would depend on the lender and not just the loan. What do we mean by this?

That an ISA should have a time limit, an ISA should have a payment cap. An ISA should not charge interest. An ISA should have an option to be paused if your income drops below the threshold.

Why should institutes adopt ISA? – It makes them accountable, but does that mean that the institute can earn dividends for their service lifelong.

Future of Income Share Agreements

In the 2 short years of our experience, we are seeing this shift starting to happen in the Ed-tech world already. If we truly want to make a more equitable world, especially in Education as a sector, Income Share Agreements are only to grow, and prosper with more institutions offering ISA-based courses, thereby increasing adoption.

If it is up to us, we will drive it to a point where either every institute adapts this or goes extinct, and we can already see a lot of ed-tech startups like Unacademy, Vedantu, Kraftshala, etc offer Income Share Agreements in one form or the other. From the pace of the current rate of adoption, it’s expected that by 2025, there’d be institutions offering ISA-backed courses in all sorts of domains ranging from Computer Science to UI/UX to marketing, to enterprise Sales. Who knows?

Concluding thoughts

At the end of the day, an ISA is a financial instrument that potentially offers a wide range of options with minimal risk but isn’t meant for everyone.

The genesis of creation enabled education, education, and learning to be more inclusive, especially in cases where finance holds you back or has a low appetite for risk.

ISAs can protect you from the vicious cycles of education loans and offer an alternative path to build someone’s professional career, and given ISA’s history of implementation, there are many success stories that further cement our belief in ISA.

Why shouldn’t the students adapt to ISA? Why should they be the sole risk-taker? If we have a money-back guarantee on food, and everything else, how can we not have this in the educational world? That too when the future of the world depends on it.

Wouldn’t it be wonderful if the educational institutions and students come together, and work as a team towards the success of the student on a cellular level, and contribute towards the growth of India, hence the world as a whole.