Pay After Placement

Pay After Placement

We believe that potential is evenly distributed across Indian society, but opportunity is not. Masai is democratising education with a unique Pay After Placement (PAP) Model. PAP allows you to study the course of your choice at ₹0 upfront fee.

Pay After Placement (PAP) Agreement

Pay After Placement (PAP) Agreement

PAP Agreement is a legal contract that makes education at Masai outcome-based. It is not an education loan, as you do not have to pay any interest & you do not require any collaterals. If you do not get placed within 1 year of course completion, your learning with Masai is completely free.

How it works?

How it works?

1

1

Pay After Placement(PAP) Agreement is a way for us to invest in your future and success. That means that we as an institution succeed only if you succeed in your career. Here is how:

Pay After Placement(PAP) Agreement is a way for us to invest in your future and success. That means that we as an institution succeed only if you succeed in your career. Here is how:

Minimum CTC

You only pay us a fee for your learning at Masai if you earn more than the threshold CTC slabs. If your salary is above the CTC of ₹3,50,000/-, the PAP monthly payments come into effect.

1 Year

If you don’t get a job offer within 1 year of course completion, you pay nothing for your learning at Masai.

Enforcement

In the event you are not working or if your income drops below the CTC mentioned in the Pay After Placement Agreement the monthly payments pause*

2

2

Course Fees

Course Fees

These only take effect once you start earning above the PAP threshold amount based on your CTC.

This table shows how much of your monthly income you will pay, based on the different possible annual incomes you may have. For more information on the Masai School ISA, please see our FAQs.

Your CTC based on your salary tier.

Category | Your Salary Range (CTC) | Monthly Payable Amount (PAP) | Tenure (in months) | Total Payable Fee (Including taxes if applicable) |

|---|---|---|---|---|

< 3.5 LPA | 0 | NA | 0 | |

A | 3.5 - 4.99 LPA | ₹ 6,944 | 36 | 2,50,000 |

B | 5 - 9.99 LPA | ₹ 9,722 | 36 | 3,50,000 |

C | 10 LPA and above | ₹ 15,000 | 30 | 4,50,000 |

CTC (Cost to Company) is defined as the total gross income earned, including but not limited, to variable pay, compensations and ESOPs. Find out more in the FAQ section.

3

3

Drop Out Clauses

Drop Out Clauses

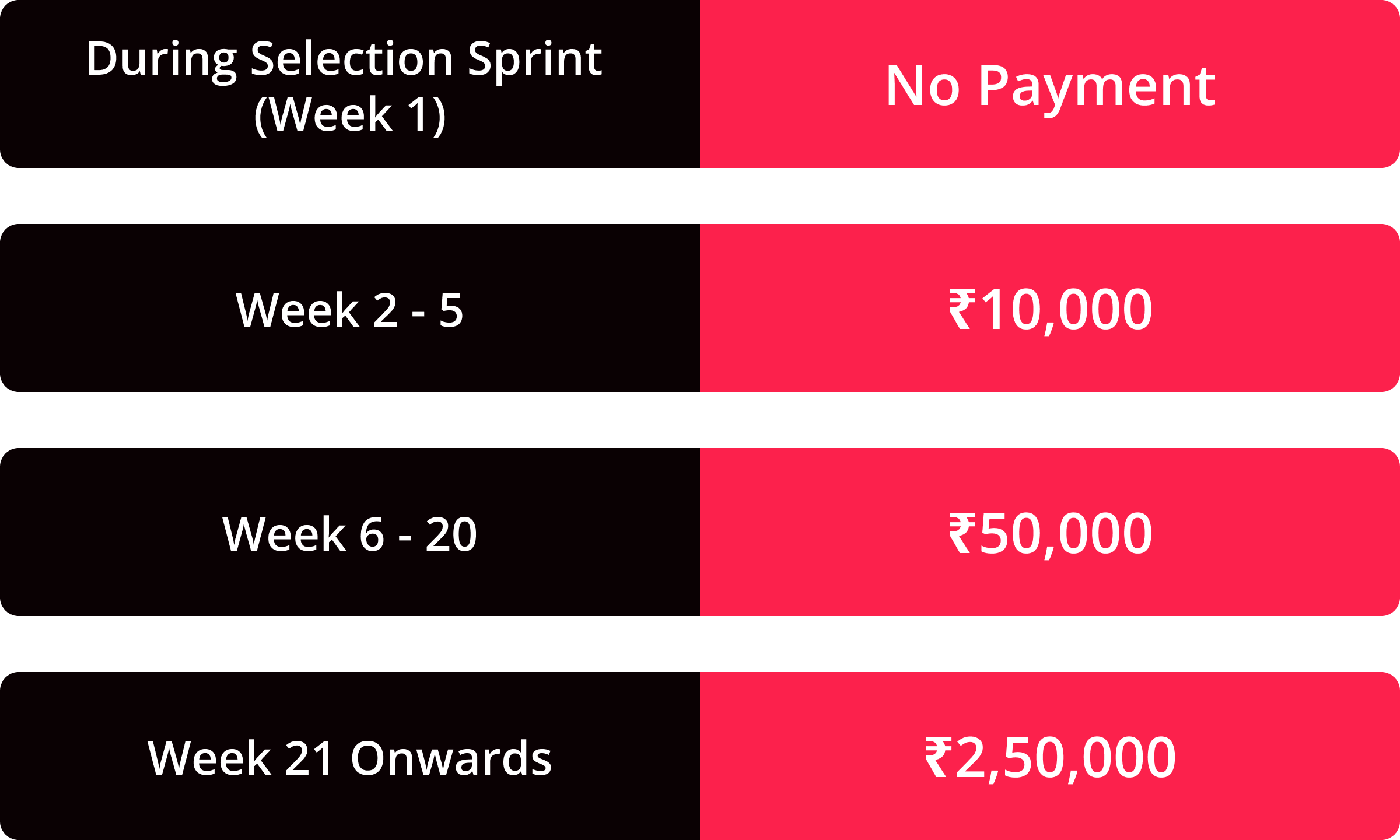

If you realise that Masai is not for you, you may withdraw from our courses at anytime. Here is how the fee works in case you drop-out

These drop-out clauses also applicable if you breach the Masai Student Code of Conduct.

Frequently asked questions

Join our Telegram

Join our Telegram